Private Capital Allocation Built to Outperform Traditional Wealth Vehicles

Arcstone Technologies operates a closed, capacity constrained capital programme designed to exceed the long-term performance of conventional investment avenues including savings instruments, public markets, and alternative asset classes.

Capital is deployed systematically with a strict focus on drawdown control, capital efficiency, and asymmetric return profiles.

Fund Status:

Allocations reviewed by request only.

Submission does not guarantee acceptance

Arcstone is not a public fund, pooled vehicle, or retail investment product.

Arcstone provides a systematic capital allocation programme executed via client-held trading accounts. Capital remains in the client’s own account at all times and is deployed using Arcstone’s proprietary execution framework.

Arcstone does not take custody of client funds.

What is Arcstone?

Segregated Accounts

Capital is held in individual client accounts with a regulated brokerage partner.

Systematic Execution

Arcstone deploys its proprietary execution logic across approved accounts within defined risk parameters.

Risk Governance

Exposure is actively managed with drawdown controls and position sizing constraints

Performance Alignment

Arcstone is compensated via a performance-based fee structure, aligning incentives with capital growth.

Detailed operational information is disclosed during the allocation review process.

How Arcstone Works

Structure & Custody

Arcstone operates a non-custodial, segregated account structure.

Client capital remains held in the client’s own trading account at a regulated brokerage partner

Arcstone does not take custody of, or have withdrawal access to, client funds

Execution is performed via Arcstone’s proprietary systematic framework

Risk parameters and exposure limits are predefined and enforced programmatically

This structure ensures transparency, capital control, and alignment between Arcstone and participating allocators.

Detailed operational and legal documentation is provided during the allocation review process.

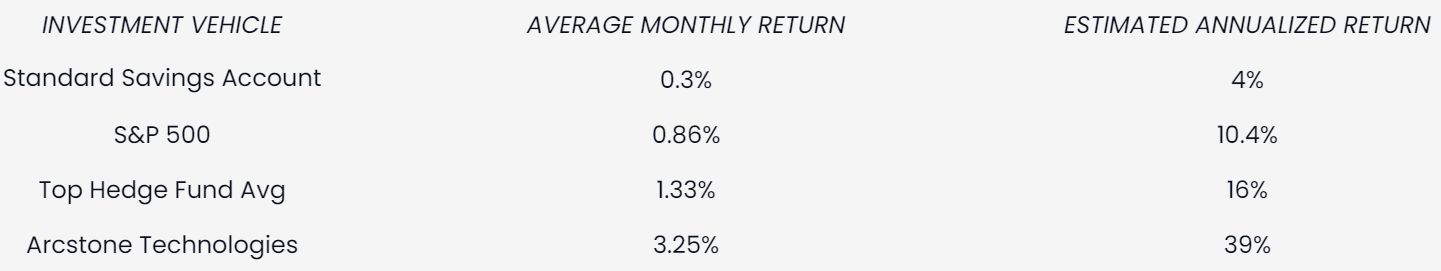

How Arcstone Compares to Other Investment Avenues

Capital allocation decisions are not made in isolation.

Returns must be evaluated relative to available alternatives, accounting for volatility, drawdowns, liquidity, and consistency over time.

Below is a comparative overview of how Arcstone’s historical performance has measured against commonly used capital vehicles.

Comparative Capital Growth Over a Five Years

Risk And Drawdown Philosophy

Arcstone does not target artificially smooth return profiles.

Periods of elevated volatility and drawdowns are an inherent feature of active capital deployment. The program is designed to manage risk dynamically, preserve capital through adverse conditions, and recover efficiently over time with a maximum drawdown on -30% cap on the account.

The objective is long-term compounding, not short-term optics. Detailed operational information is disclosed during the allocation review process.

Submission

Prospective allocators submit an allocation review request.

Preliminary Assessment

Capital size, time horizon, and mandate alignment are reviewed.

Disclosure & Verification

Approved parties receive access to detailed performance data, verification, and operational documentation.

Onboarding

If accepted client will receive all the relevant instructions on how to connect to our system

What Happens Next

Submission does not guarantee acceptance